- The Daily Trade

- Posts

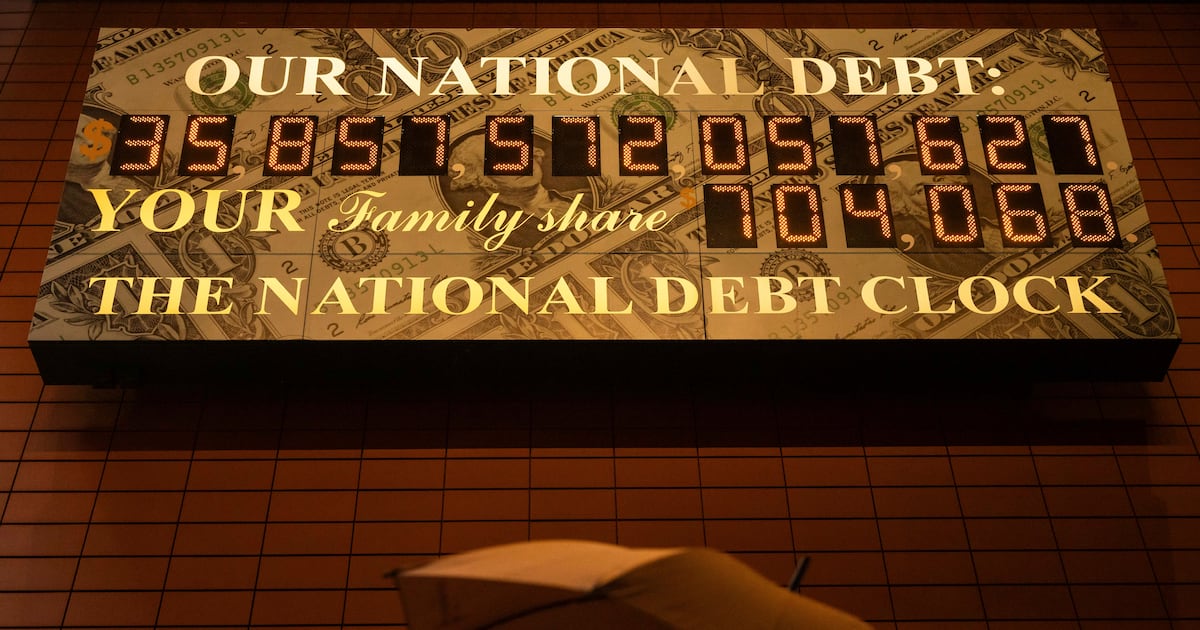

- 🏦 Debt Ceiling Showdown Looms Ahead

🏦 Debt Ceiling Showdown Looms Ahead

The

Daily Trade

Hey Daily Traders,

The U.S. Treasury Department has sounded the alarm on a potential debt ceiling crisis, warning that the nation could hit its borrowing limit by August unless Congress intervenes. The urgency is underscored by Treasury Secretary Scott Bessent's call for action before the summer recess, as failure to address this could disrupt financial markets and escalate borrowing costs.

Meanwhile, Lennar is transforming Oceanside living with the launch of North River Farms, a master-planned community featuring five distinct home collections. With a focus on modern amenities and a relaxed lifestyle, this development offers a compelling option for homebuyers in Southern California, backed by Lennar's Everything's Included® program for premium finishes.

Here's what's happening today:

- 💰 U.S. nears debt ceiling, urgent action required

- 🏡 Lennar launches new community in Oceanside, CA

- 🤖 New AI trading engine launched by Sunrise Pact

- 🎁 +10 more business & investing news stories you might like

- 📊 +4 technical analysis results

Question

Do you think Congress will reach a consensus on the debt ceiling before the August deadline, or are we headed for another financial standoff?

Reply to this email with your answer

Try Therapy, Completely Free from BetterHelp

Stigma, cost, and confusion keep too many people from getting help. BetterHelp is working to change that. For Mental Health Awareness Month, they’re offering 1 free week of therapy, because getting started shouldn’t be the hardest part.

Sign up, take a brief quiz, and you’ll be matched with a licensed therapist in under 48 hours. With over 35,000 professionals and a 4.9/5 average session rating, you’re in good hands. No waiting rooms, no commute: just support when you need it.

This May, try therapy risk-free.

Stock Market  The U.S. Treasury Department has warned that the country could hit its borrowing limit by August if Congress does not act to raise or suspend the debt ceiling. Treasury Secretary Scott Bessent has urged lawmakers to reach a deal before their summer recess, highlighting the severe consequences of not doing so, including harm to financial markets and increased borrowing costs. House Republicans are pushing a $5 trillion debt limit increase as part of a broader reconciliation package. However, internal disagreements and lack of bipartisan support pose challenges to timely passage. The debt ceiling has been a recurring issue, with Congress historically acting to prevent default, but the current political climate adds uncertainty to the process. Key Takeaway

|

Real Estate Lennar has announced the launch of North River Farms, a master-planned community in Oceanside, California, offering five distinct home collections with spacious layouts and modern amenities. The community is designed to promote a laid-back lifestyle with features like pools, pickleball courts, and trails, all within proximity to the beach and local attractions. Homes in North River Farms range from 2,265 to 4,764 square feet, with Lennar's Everything's Included® program ensuring top-tier finishes. The development is strategically located for easy access to major highways, making it an attractive option for buyers across Southern California. With prices starting in the mid-$1,000,000s, Lennar aims to cater to a diverse range of homebuyers. Key Takeaway

|

Stock Market Sunrise Pact Investment Alliance has launched a new intelligent market engine, leveraging Alaric Wainwright's NeuroGrid AI framework to enhance trading operations. The engine integrates real-time data capture and automated execution, providing institutional investors with a comprehensive solution for navigating market volatility. Key features include a live signal core, execution synchronizer, and risk containment layer, all designed to improve trading precision and efficiency. The rollout will initially target select financial partners, with educational resources provided to ensure seamless adoption. This development positions Sunrise Pact as a leader in intelligent trading solutions. Key Takeaway

|

More Business & Investing news

- 🌍 Trump seeks Middle East investments for U.S. (Link)

- 📈 Insurance IPOs perform well in the market (Link)

- 💸 Lockheed Martin announces quarterly dividend (Link)

- 📉 Trump considers cutting China tariffs to ease tensions (Link)

- 🎰 BitStarz offers crypto-friendly casino bonuses (Link)

- 🚗 Tesla's EV market share declines in China (Link)

- 💼 Small businesses hit hard by Trump's tariffs (Link)

- ⛽ California gas prices could soar by 2026 (Link)

- 🚙 Gov. Newsom opts for Rivian over Tesla (Link)

- 🇬🇧 Trump's UK trade deal lacks comprehensive scope (Link)

Today's Technical Analysis

RSI Sell | MFI Sell | WillR Sell | AO Sell |

CCI Sell | BBANDS Sell | ULTOSC Hold | STOCH Sell |

RSI Sell | MFI Sell | WillR Sell | AO Sell |

CCI Sell | BBANDS Sell | ULTOSC Hold | STOCH Sell |

RSI Sell | MFI Sell | WillR Sell | AO Sell |

CCI Sell | BBANDS Sell | ULTOSC Hold | STOCH Sell |

RSI Sell | MFI Sell | WillR Sell | AO Sell |

CCI Sell | BBANDS Hold | ULTOSC Sell | STOCH Sell |

You might also like…

We’re always looking for opportunities to bring our readers more value so we’ve partnered with a handful of companies that we think you might enjoy.

If you have suggestions for companies we should partner with, let us know and we’ll reach out to them.

Do you have an idea for a new website or mobile app?

Under the leadership of tech entrepreneurs, Modern Launch develops software applications from scratch.

Are you looking for your next real estate investment?

Every day, Labrador scans the MLS and runs a cash-flow analysis on every property to deliver only the highest ROI opportunities.

Do you want to try the best wines?

Get weekly wine recommendations from top sommeliers at Pour Decisions.

Want to explore other newsletters?

Take a look at some of the other newsletters our readers love.

Thanks for Reading!

Have ideas to improve our newsletter? Let us know

Want to reach our readers? Become a sponsor

Was this email forwarded to you? Subscribe here

How would you rate today's newsletter?If there's anything I can do better, please reply to this email and let me know! |

Technical Indicator Information

Relative Strength Index (RSI) | Period: 14 days | Overvalued threshold: 70 | Undervalued threshold: 30

Money Flow Index (MFI) | Period: 14 days | Overvalued threshold: 80 | Undervalued threshold: 20

Williams Percent Range (WillR) | Period: 14 days | Overvalued threshold: -20 | Undervalued threshold: -80

Aroon Oscillator (AO) | Period: 14 days | Overvalued threshold: 75 | Undervalued threshold: -75

Moving Average Convergence/Divergence (MACD) | Period: 26/12/9 days | Overvalued threshold: MACD crosses below MACD Signal | Undervalued threshold: MACD crosses above MACD Signal

Stochastic Oscillator (STOCH) | Period: 14/3/3 days | Overvalued threshold: %K crosses below %D above 80 | Undervalued threshold: %K crosses above %D below 20

Commodity Channel Index (CCI) | Period: 20 days | Overvalued threshold: 100 | Undervalued threshold: -100

Bollinger Bands (BBANDS) | Period: 20 days | Overvalued threshold: price >= upper band | Undervalued threshold: price <= lower band

Parabolic Stop and Reverse (SAR) | Period: variable 50 - 100 days | Overvalued threshold: SAR crosses above price | Undervalued threshold: SAR crosses below price

Triple Exponential Average (TRIX) | Period: 15 days | Overvalued threshold: TRIX crosses below 0 | Undervalued threshold: TRIX crosses above 0

Ultimate Oscillator (ULTOSC) | Period: 28/14/7 days | Overvalued threshold: 70 | Undervalued threshold: 30

Directional Movement Index (DMI) | Period: 14 days | Overvalued threshold: PlusDI crosses below MinusDI | Undervalued threshold: PlusDI crosses above MinusDI

Average Directional Index (ADX) | Period: variable 14 days | Requirement: >= 25

Analysis is only performed on securities with market caps in excess of $100 million and with daily trade volume in excess of $50 million.

Disclaimers

The information in our newsletter is not intended to constitute investment advice and is not designed to meet your personal financial situation. It is provided for information purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. No recommendation or advice is being given as to whether any investment is suitable for a particular investor or a group of investors. It should not be assumed that any investments in securities, companies, sectors or markets identified and described will be profitable. We strongly advise you to discuss your investment options with your financial advisor prior to making any investments, including whether any investment is suitable for your specific needs.

Although we obtain information contained in our newsletter from sources we believe to be reliable, we cannot guarantee its accuracy. The analysis provided in this newsletter is based on the prior trading day’s closing prices and may not reflect after-hours trading, earnings announcements, or other significant market events that occur outside regular trading hours. As such, any data or commentary may not fully capture the latest market movements or emerging factors. For the most current and comprehensive view, please consider additional sources or consult with a qualified financial professional.

The information provided in our newsletter is private, privileged, and confidential information, licensed for your sole individual use as a subscriber. We reserve all rights to the content of this newsletter. Forwarding, copying, disseminating, or distributing this newsletter in whole or in part, including substantial quotation of any portion the publication or any release of specific investment recommendations, is strictly prohibited.