- The Daily Trade

- Posts

- Google's AI Mode: Search Revolution 🌐

Google's AI Mode: Search Revolution 🌐

The

Daily Trade

Hey Daily Traders,

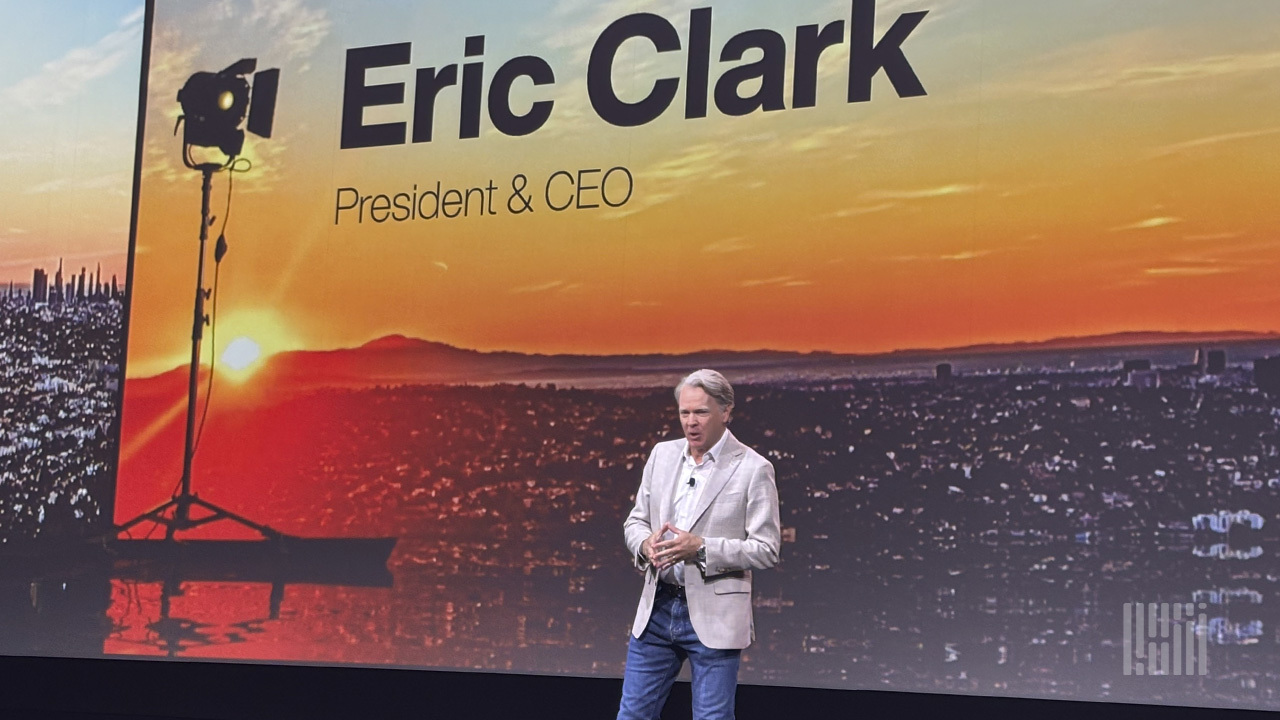

Manhattan Associates has taken center stage at their Momentum conference in Las Vegas, introducing Eric Clark as the new CEO and unveiling AI-driven software innovations. This leadership change and the focus on AI highlight the company's strategic pivot to enhance its supply chain solutions, amidst a stock price that has seen significant volatility.

Meanwhile, Google's AI Mode is set to transform the search landscape, as announced at the Google I/O conference. This new feature, built on the Gemini AI platform, aims to provide a more interactive and personalized search experience, though it raises concerns among publishers about potential impacts on clickthrough rates.

Here's what's happening today:

- 🔗 Manhattan Associates debuts new CEO at conference

- 🤖 Google rolls out AI Mode for everyone

- 🏎️ Disney and Formula 1 team up for 2026

- 🎁 +10 more business & investing news stories you might like

- 📊 +4 technical analysis results

Trivia time!In 2001, Goldman Sachs coined the phrase BRIC as an acronym for the four biggest developing economies: Brazil, Russia, India, China. Located on Cape Agulhas, what fifth country added an S to the acronym in 2010? |

He’s already IPO’d once – this time’s different

Spencer Rascoff grew Zillow from seed to IPO. But everyday investors couldn’t join until then, missing early gains. So he did things differently with Pacaso. They’ve made $110M+ in gross profits disrupting a $1.3T market. And after reserving the Nasdaq ticker PCSO, you can join for $2.80/share until 5/29.

This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals. Under Regulation A+, a company has the ability to change its share price by up to 20%, without requalifying the offering with the SEC.

Stock Market  Manhattan Associates' Momentum conference in Las Vegas marked the debut of their new CEO, Eric Clark, succeeding Eddie Capell. The company, known for its supply chain software, has experienced volatile stock performance, trading at about $190 per share recently, with a 52-week high of $312.60 and a low of $140.81. The conference emphasized new software capabilities, particularly focusing on AI, highlighting the industry's shift towards artificial intelligence. Clark's leadership transition appeared abrupt but was a planned move to enhance the company's focus on innovation. The stock has seen a 16.5% rise in the past month, reflecting investor optimism. As the industry leans into AI, Manhattan Associates aims to leverage these technologies to strengthen its market position and address the evolving needs of its clients. Key Takeaway

|

Stock Market  At the Google I/O conference, Google announced the rollout of its AI Mode, a conversational interface that enhances search capabilities for users in the US. CEO Sundar Pichai highlighted the success of AI Overview, which has increased search usage by 10% in the US and India. The AI Mode is designed to handle complex queries using Google's Gemini AI platform, promising a more interactive and personalized search experience. Despite the advancements, concerns arise among publishers about reduced clickthrough rates. Google claims that AI Overview results in higher quality visits, though specific metrics were not disclosed. Additional features, like Search Live and virtual try-ons, are set to further integrate AI into everyday activities, reflecting Google's commitment to evolving its search product through innovative technologies. Key Takeaway

|

Question

What are your thoughts on Google's AI Mode transforming search experiences—do you believe it will enhance your online interactions, or are you concerned about potential impacts on publisher content visibility?

Reply to this email with your answer

Stock Market Disney and Formula 1 announced a collaboration that will bring Mickey & Friends into the world of high-speed racing starting in 2026. This partnership aims to merge Disney's entertainment prowess with Formula 1's global sporting appeal, offering fans unique experiences and merchandise. The collaboration aligns with Formula 1's strategy to expand beyond traditional sports and engage with a broader consumer market. With Formula 1's growing younger fanbase, this partnership is poised to attract new audiences and enhance brand engagement for both Disney and Formula 1. The initiative reflects both companies' commitment to creativity and innovation, promising exciting developments for fans worldwide. Details on the collaboration will be unveiled in the coming months, creating anticipation for what's to come. Key Takeaway

|

More Business & Investing news

- 🌍 CooperCompanies highlights sustainability in 2024 report (Link)

- 💰 Northrop Grumman hikes dividend by 12% (Link)

- 📉 Palo Alto stock dips despite earnings beat (Link)

- 🏗️ Switch buys Las Vegas land for $15M (Link)

- 🔍 Musk to reduce political spending after $250M Trump backing (Link)

- 🏠 U.S. housing market shows signs of correction (Link)

- 🚗 Cadillac EVs lure Tesla owners (Link)

- 💳 Riot Platforms expands credit with Coinbase (Link)

- 🖥️ Red Hat boosts open source AI offerings (Link)

- 🌬️ Trump allows NY offshore wind project to proceed (Link)

Today's Technical Analysis

RSI Sell | MFI Sell | WillR Sell | AO Sell |

CCI Sell | BBANDS Hold | ULTOSC Sell | STOCH Sell |

RSI Sell | MFI Sell | WillR Sell | AO Sell |

CCI Sell | BBANDS Hold | ULTOSC Sell | STOCH Sell |

RSI Sell | MFI Sell | WillR Sell | AO Sell |

CCI Sell | BBANDS Hold | ULTOSC Sell | STOCH Sell |

RSI Sell | MFI Sell | WillR Sell | AO Sell |

CCI Sell | BBANDS Hold | ULTOSC Sell | STOCH Sell |

You might also like…

We’re always looking for opportunities to bring our readers more value so we’ve partnered with a handful of companies that we think you might enjoy.

If you have suggestions for companies we should partner with, let us know and we’ll reach out to them.

Do you have an idea for a new website or mobile app?

Under the leadership of tech entrepreneurs, Modern Launch develops software applications from scratch.

Are you looking for your next real estate investment?

Every day, Labrador scans the MLS and runs a cash-flow analysis on every property to deliver only the highest ROI opportunities.

Do you want to try the best wines?

Get weekly wine recommendations from top sommeliers at Pour Decisions.

Want to explore other newsletters?

Take a look at some of the other newsletters our readers love.

Thanks for Reading!

Have ideas to improve our newsletter? Let us know

Want to reach our readers? Become a sponsor

Was this email forwarded to you? Subscribe here

How would you rate today's newsletter?If there's anything I can do better, please reply to this email and let me know! |

Technical Indicator Information

Relative Strength Index (RSI) | Period: 14 days | Overvalued threshold: 70 | Undervalued threshold: 30

Money Flow Index (MFI) | Period: 14 days | Overvalued threshold: 80 | Undervalued threshold: 20

Williams Percent Range (WillR) | Period: 14 days | Overvalued threshold: -20 | Undervalued threshold: -80

Aroon Oscillator (AO) | Period: 14 days | Overvalued threshold: 75 | Undervalued threshold: -75

Moving Average Convergence/Divergence (MACD) | Period: 26/12/9 days | Overvalued threshold: MACD crosses below MACD Signal | Undervalued threshold: MACD crosses above MACD Signal

Stochastic Oscillator (STOCH) | Period: 14/3/3 days | Overvalued threshold: %K crosses below %D above 80 | Undervalued threshold: %K crosses above %D below 20

Commodity Channel Index (CCI) | Period: 20 days | Overvalued threshold: 100 | Undervalued threshold: -100

Bollinger Bands (BBANDS) | Period: 20 days | Overvalued threshold: price >= upper band | Undervalued threshold: price <= lower band

Parabolic Stop and Reverse (SAR) | Period: variable 50 - 100 days | Overvalued threshold: SAR crosses above price | Undervalued threshold: SAR crosses below price

Triple Exponential Average (TRIX) | Period: 15 days | Overvalued threshold: TRIX crosses below 0 | Undervalued threshold: TRIX crosses above 0

Ultimate Oscillator (ULTOSC) | Period: 28/14/7 days | Overvalued threshold: 70 | Undervalued threshold: 30

Directional Movement Index (DMI) | Period: 14 days | Overvalued threshold: PlusDI crosses below MinusDI | Undervalued threshold: PlusDI crosses above MinusDI

Average Directional Index (ADX) | Period: variable 14 days | Requirement: >= 25

Analysis is only performed on securities with market caps in excess of $100 million and with daily trade volume in excess of $50 million.

Disclaimers

The information in our newsletter is not intended to constitute investment advice and is not designed to meet your personal financial situation. It is provided for information purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. No recommendation or advice is being given as to whether any investment is suitable for a particular investor or a group of investors. It should not be assumed that any investments in securities, companies, sectors or markets identified and described will be profitable. We strongly advise you to discuss your investment options with your financial advisor prior to making any investments, including whether any investment is suitable for your specific needs.

Although we obtain information contained in our newsletter from sources we believe to be reliable, we cannot guarantee its accuracy. The analysis provided in this newsletter is based on the prior trading day’s closing prices and may not reflect after-hours trading, earnings announcements, or other significant market events that occur outside regular trading hours. As such, any data or commentary may not fully capture the latest market movements or emerging factors. For the most current and comprehensive view, please consider additional sources or consult with a qualified financial professional.

The information provided in our newsletter is private, privileged, and confidential information, licensed for your sole individual use as a subscriber. We reserve all rights to the content of this newsletter. Forwarding, copying, disseminating, or distributing this newsletter in whole or in part, including substantial quotation of any portion the publication or any release of specific investment recommendations, is strictly prohibited.